Wills and Estate Lawyers

Wills and Powers of Attorney are covered in our comprehensive estate planning service.

We ensure your assets are protected and loved ones are provided for in the future.

No family is the same, so we take the time to understand your dynamics and your wishes so that we can provide you with the best strategies to achieve the outcomes you desire.

There are many reasons why you should consider a will and estate planning and ways which we can help you, including:

Choose your preferred people to raise your children and look after their inheritance, should you die whilst they are still minors

Organise your affairs to provide for your children throughout their childhoods and prevent unnecessary tax bills

Direct who gets your superannuation

Prevent your Will being challenged by jilted lovers or family members

Ensure your medical wishes are respected and someone can make those decisions for you if you can’t

Let your family know any funeral or burial wishes

Deal with the effect of marriage on any previous Wills

Make sure that your de facto or same sex partner is treated the way you want

Ensure your digital assets end up where and how you want them

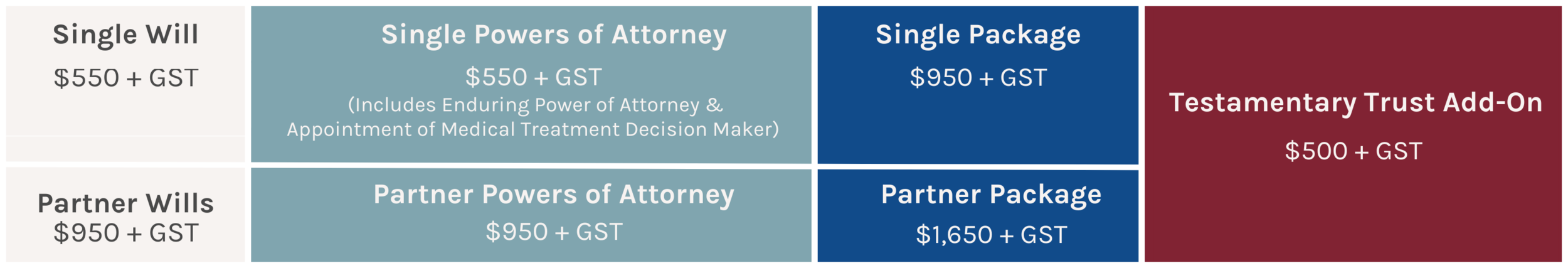

Because we want to make your estate planning simple, we’ve made our fee structure simple with fixed fees for preparation of wills, powers of attorney and testamentary trusts.

Starting your estate planning matter with us is as simple as using the link below to provide your details through our online client intake form. Or contacting us direct to arrange a conference time.

We will meet with you either in person or by videoconference we can go over the information you have provided, discuss your wishes and provide you with advice and options.

We will then provide you with drafts of the documents for you to review before arranging a final conference for you to attend and execute the documents.

FAQs

-

Anyone over the age of 18 with legal capacity can make a Will. Legal capacity means that you’re of sound mind, you know what a Will is and does.

Spouses will need to make individual Wills as each person needs to have their own Will.

-

You should consider making or updating your Will after major life events. Such as: marriage or divorce, having a child or buying property.

You should review your Will regularly to ensure that it meets your current needs and reflects your wishes.

-

Your Executor is who you chose to be responsible for carrying out the wishes expressed in your Will.

They make sure your estate is dealt with in the way that you want and will include identifying assets, applying for probate and distributing your estate.

Your Executor may also need to make investment decisions or be responsible for holding gifts for beneficiaries who are under the age of 18.

-

A beneficiary is a person or entity which receives a gift or benefit from your estate. This can be your spouses, family member but also charitable organisations.

There are certain requirements to consider when deciding who should benefit from your estate.

-

Making a Will with Grice Legal is simple.

Using the link above, you can start your Will with us online at a time and place that suits you.

Alternatively, you can contact our office and speak with one of our team.

Let’s get started

Hours

Monday – Friday

8.30am – 5.00pm

Phone

+61 3 9831 5700

Level 1

283 Whitehorse Road

BALWYN VIC 3103

Yarra Trams route 109, between stops 46 & 47